An Overview

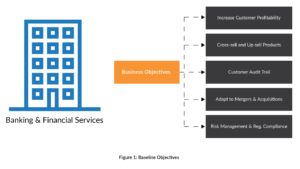

The baseline business objectives for the Banking and Financial Services Industry revolve around the following aspects:

- Increasing customer profitability

- Identifying potential customers to cross-sell and up-sell products/services

- Acquiring customers with better business potential

- Improving risk management

- Accurately tracking customer information for improved auditing capability

- Efficiently adapting to mergers and acquisitions

- Meeting regulatory compliance

Banking and Financial Services, in general, is an intensively data-driven industry, managing large quantities of customer data and using analytics in areas such as capital market trading. Underwriting professionals work towards mitigating risks by analyzing large amounts of data, making data a governing force in the sector.

Challenges

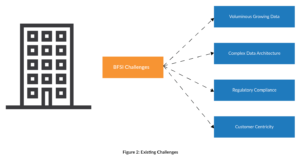

The following are the typical challenges that drive the Banking and Financial Services Industry into Master Data Management initiatives:

Complex Data Architecture

The sheer volume of data is managed by numerous stakeholders, leading to a lack of data ownership. Each business unit (Retail, Loans and Deposits, Credit, etc.) stores data in specific silos and mostly in legacy systems. Integration of data between these systems, for cards, payment processing, etc., remain a challenge and only lead to crippled decision-making for the business as a whole. Data ownership is still predominantly fragmented, and is driven by multiple stakeholders and frequently measured at a departmental level, rather than at an organizational level.

Customer Centricity

Advances in technology and communication have empowered a change in consumer dynamics, urging the finance sector to become a customer-centric industry and focus on developing an improved customer engagement strategy. About 70% of executives from the finance sector emphasize the importance of customer centricity. But, here come the questions:

- Do banks “know” their customers?

- Are the financial products “relevant” to customers?

- Are banks providing a “multi-channel” experience?

- Do customers “trust” bankers?

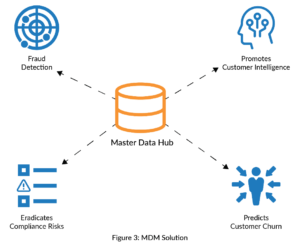

How Master Data Management Helps

Master Data Management enables the Banking and Financial Services Industry to make the best use of data for a competitive advantage.

Increased Business Profitability

Being a central repository of all data, an MDM solution addresses the key objective of promoting revenue and margin. MDM helps in identifying the specific needs of customers to better cater to those customers, and aids in customizing services to drive new customer demands. MDM enables marketing teams to optimize cross-sell, up-sell, and product bundling offers, thus helping banks increase customer acquisition, increase revenue per customer, decrease costs to acquire and retain, reduce customer attrition, and improve product sales.

Compliance Risks Eradicated

MDM allows organizations to understand and mitigate compliance risks by helping organizations manage data quality, centrally. Every MDM solution in the market comes decked with features, which enable organizations to identify and eradicate any data quality issues. This effectively ensures clean and accurate data is consistently sent to audit teams to reduce, and even remove regulatory fines.

Conclusion

A well-defined MDM strategy, compounded with reference data management and improved data governance processes, establishes a holistic view of the customer, thereby constructing robust relationships leading to healthier business.

Many financial companies have enabled a single customer view across online and offline channels, improving the lead conversion rate by over 100%. Mastech InfoTrellis’s Master Data Management solutions can help achieve this in an optimal time frame.

Kevin Pochapin

Vice President